Advertisement

Lytix raises more than NOK 110 million through a directed issue and private issue to retail investors

The PrimaryBid Offering attracted strong interest from both new and existing investors, with participation from over 200 retail investors across Norway, Denmark and Finland.

The company has a licensing agreement with US listed Verrica Pharmaceuticals for treatment of basal cell carcinoma.

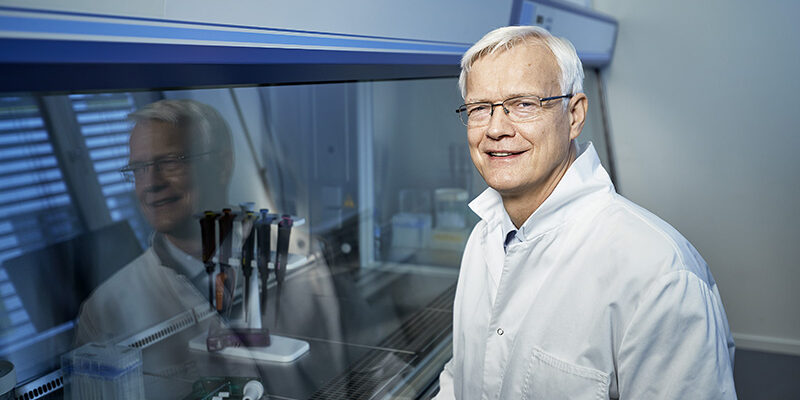

“Lytix is now a mature biotech company with a robust and promising portfolio of clinical studies in large cancer indications globally. This capital raise allows us to fast-track our lead drug candidate LTX-315 towards commercialization through a potential phase III study with our licensing partner Verrica, whilst at the same time bring our next generation molecule LTX-401 into clinical stage”, says Øystein Rekdal, CEO, Lytix Biopharma.

“We end 2024 on a high note”

“We are very happy having concluded a successful capital raise, with both strong support from existing shareholders, as well as bringing onboard new and solid investors. In addition, I am very happy to see the significant and increased interest from retail investors that participated in the offering through PrimaryBid and Nordnet. We end 2024 on a high note and look forward to progress our development into 2025, with several exciting milestones ahead,” says Rekdal.

Published: December 18, 2024

Advertisement