Advertisement

Do’s and don’ts for young companies on their journey to market

In a financial market that’s still catching its breath after the repeated turmoil of the past few years, many up-and-coming life science companies in the Nordics are struggling to secure investments and bring their product to market.

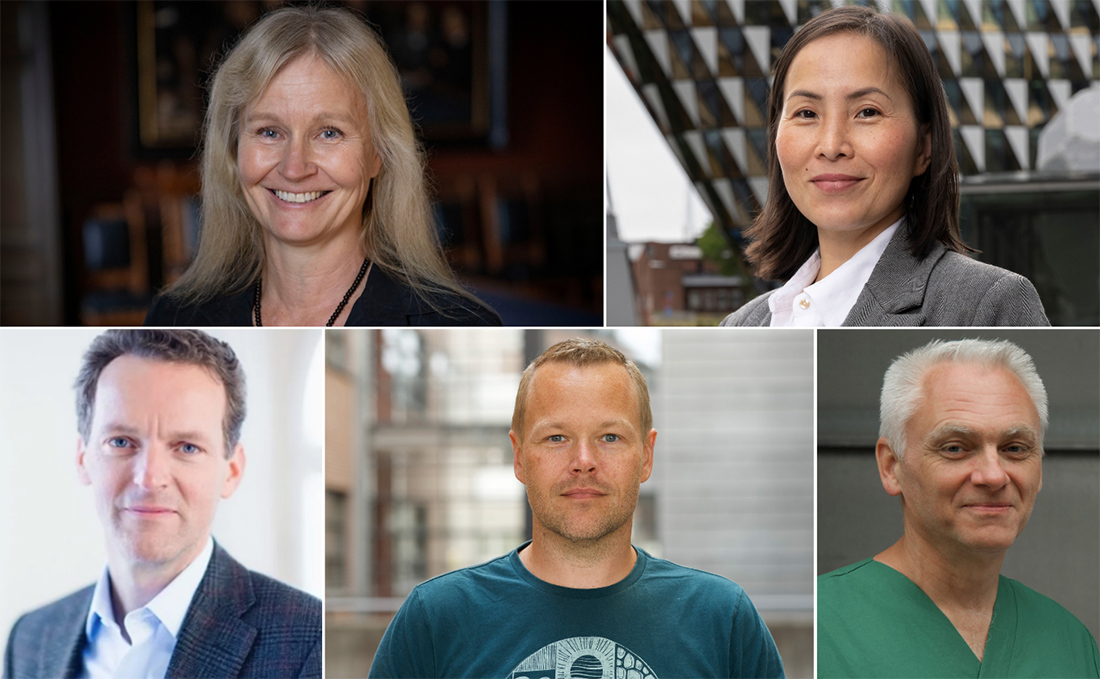

Tero Piispanen, Senior Executive at Business Turku, who primarily works with life science companies in the start-up or growth phase, laments the lack of funding for young companies in his region of Finland.

“It looks to me like this year has not been as successful as earlier years,” he says. “In general there is a lack of early-phase venture capital, which leads to the formation of fewer start-ups than we’d like to see.”

In general there is a lack of early-phase venture capital, which leads to the formation of fewer start-ups than we’d like to see.

Early-phase funding and seed rounds generally tend to be too small, and the funding sector is not well developed enough, neither in Finland nor in Europe, according to Piispanen. On the bright side though, crowd-funding has been a positive addition to venture capital in Finland, and new angel investors are starting to emerge.

“I am always complaining about the funding but luckily the situation in Finland is starting to improve,” Piispanen says, and continues: “The Finnish government has decided to establish a national drug discovery center, called Finnish Drug Discovery Center (FDDC) to function as a venture-capital actor and help bring innovations further towards company formation.”

It’s been a bit chaotic, but things are starting to look up now.

On the other side of the Baltic Sea, in Sweden, Business Region Göteborg’s life science investment advisor, Iris Öhrn, muses over recent challenges for Swedish companies.

“The financial situation in Sweden has been tough, since there are so many listed companies here. When the financial markets started to turn, a lot of the investors pulled out their money as stock markets went down, which put many companies in a precarious situation,” she says. “It’s been a bit chaotic, but things are starting to look up now.”

Nordic Life Science asked Tero Piispanen and Iris Öhrn to share their top advice and things to avoid, for companies trying to attract investment and secure their path to market.

1. Tailor your investment strategy and your pitch

“It’s crucial to create an investment strategy that’s tailored to the type of investor you’re trying to attract. Big pharma companies, angel investors, and venture capitalists all have their own priorities, and you need to address them accordingly,” says Öhrn.

When it’s time to pitch to an investor, you have to adjust the pitch to the person you’re talking to.

“When it’s time to pitch to an investor, you have to adjust the pitch to the person you’re talking to. Take the time to find out what position they have in the company and identify what it is they want to achieve. For instance, depending on whether they are the gatekeeper, the evaluator or the decision maker you will need to raise different aspects of your business,” she adds. “Companies need to get a better understanding of investors as a stakeholder group. If you don’t manage to do that, you won’t nail the pitch with a compelling reason for them to invest in your company or innovation.”

2. Ask investors for advice, not just money

“Normally, venture capitalists want to be helpful. You can absolutely go to them for advice – don’t just meet them to be seen and make connections, but actually ask for their advice. This is a great way to go out and try to meet with potential investors and future clients,” advises Piispanen.

Normally, venture capitalists want to be helpful. You can absolutely go to them for advice – don’t just meet them to be seen and make connections, but actually ask for their advice.

“I’ve met investors who tell me that they meet many companies asking for funding, and sometimes the answer is no, but the companies don’t take the opportunity to ask the investors they interact with any questions. The companies can ask for advice or for feedback on their pitch. They only ask for funding, but not for help, which is a lost opportunity as the investors are best-placed to know what a successful pitch looks like,” says Öhrn.

3. Focus on commercial potential and competition

“There is not enough focus on how they intend to be commercially successful. But the investors want to make money, so you need to be able to tell them how you’re going to position yourself on the market,” says Öhrn. “You have to start your market analysis early in the process of company creation. It’s not just a matter of counting how many patients your product can help, but about what the market looks like, how many other products already meet this patient group’s needs, what type of products are out there, and what’s trending.

You have to start your market analysis early in the process of company creation.

“Another thing to be aware of are other emerging products. The life science industry moves fast, so it’s crucial to keep an eye on what the competitors are doing. Sometimes, another company is developing a product that addresses the same needs as you, and if they reach the market first you may find that the market is saturated already by the time your product is ready,” adds Öhrn.

4. Start marketing and networking early

“I’ve noticed that many early-phase companies don’t start their marketing early enough. They don’t realize that they have to start raising awareness early on, and so they don’t start going to partnering events at the beginning of their company’s journey. But dealmaking isn’t done over a couple of months, these processes take a long time. Young companies should get out there and participate in pitch competitions and find other ways to engage with investors and potential clients,” says Piispanen.

When the time comes to put money on the table, many investors opt to go by connections.

“You have to meet and get to know the investors. Go to events and networking mingles and conferences. Don’t just do it when you need to raise capital, do it to build long-term relationships. When the time comes to put money on the table, many investors opt to go by connections – it’s a matter of who you know and trust. So go out and meet people whenever you can!” emphasizes Öhrn.

Updated: November 4, 2024, 03:41 pm

Published: October 27, 2024

Advertisement